Buy with Confidence. Build Your Future.

Avoid Costly Mistakes, Understand Your Rights, and Secure the Home You Deserve

How to Protect Yourself During the Buying Process (7 Ways)

You write an offer, and the seller accepts it. You do now have a legally binding agreement to purchase a home. But what if you find something that’s a deal breaker? Here are 7 ways to conduct due diligence and legal ways to get out of buying a nightmare.

The Buying Process with Practical Steps and Proven Strategies

Getting Pre-approved: Understanding Your Budget (1/5)

1. What is a Preapproval?

2. Benefits of Getting PreApproved

3. Steps to Get PreApproved

4. Understanding Your Budget

5. Common Mistakes to Avoid

6. FAQ: PreApproval

Home Hunting Made Easy: Simplify Your Search (2/5)

1. Set Your Budget

2. Define Your Needs and Wants

3. Set Up an Auto-Search

4. Tips for Showings

Making an Offer: Strategies for Success (3/5)

1. The Most Important Thing to Know When Making an Offer

2. How to Determine Your Offer Price

3. Learn the Seller’s Motivation

4. What if it’s My Dream Home?

5. Submit an Offer with a PreApproval Letter

6. Write a Personalized Letter to the Seller

Escrow: What to Expect and How to Prepare (4/5)

1. What is Escrow? Why Does it Matter?

2. How Long Does Escrow Take?

3. What are Your Responsibilities During Escrow

4. Timeline of Events During Escrow

How to Protect Yourself in the Buying Process (5/5)

1. Understanding The Contract: Know Your Rights

2. Home Inspection Contingency

3. Seller Real Property Disclosure Statement

4. Condo/Association Documents

5. Termite Inspection Contingency

6. Survey Contingency

7. Title Report Contingency

8. Financing Contingency

How to Avoid Losing Your Dream Home to Another Buyer

1. The Most Important Thing to Know When Making an Offer

Does the seller already have offers in hand, or are they expecting any? Knowing this will help you understand whether you’re competing against other buyers, which will shape your strategy.

2. How to Determine Your Offer Price

Start by understanding the market value of the home, validated by comparable sales. This will give you a clear idea of what a fair price is.

From there, adjust your offer based on the level of competition and how much you want the home.

Pro Tip: Ask yourself: “If I lost to another buyer by $5,000, would I be okay with that?” If the answer is yes, then you’ve likely found your ceiling.

3. Learn the Seller’s Motivation

What does the seller want most? Are they looking for a quick sale, a good family to take care of their home, or fewer contingencies? Understanding what’s important to the sellers allows you to tailor your offer to meet their needs, making it more attractive.

4. What if it’s My Dream Home?

If this is your dream home and you have to beat out other competing buyers, consider these strategies to make your offer stand out:

- Offer the highest price you’re willing to pay, as sellers often prioritize price.

- Add favorable terms for the sellers, like waiving contingencies, adding appraisal language, including an escalation clause, offering to pay for the termite inspection, and other special terms that make the offer more appealing to the sellers.

- Use the strategies in this guide to maximize your chances of standing out and winning against competing buyers.

5. Submit an Offer with a PreApproval Letter

Submitting your offer with a pre-approval letter and verification of cash funds gives sellers confidence in your ability to purchase.

Pro Tip: Have your lender (if applicable) call the seller’s agent directly to provide further confidence in your financial ability to purchase.

6. Write a Personalized Letter to the Seller

Sellers who have lived in their home for a long time often want to know it will go to someone who will care for it. A personalized letter can humanize you and help the seller see you as more than just another buyer.

Real Life Story:

We helped our client secure their dream home despite facing multiple competing offers—including one that was $100,000 higher. What made the difference? A personal connection. The sellers and our buyers shared the same high school, college, and dental school, and the sellers saw a reflection of themselves 30 years ago.

Mortgage Calculator

Mortgage Calculator

Tip: Adjust tax %, HOA, and insurance for realistic Hawaii payments (condos often have AOAO dues).

Monthly Payment

See payment breakdown & amortization

Hawaii's Unique Real Estate Market

Hawaii’s real estate market stands apart for its enduring strength and exclusivity. With limited land, a deep respect for natural beauty, and strong demand from both local residents and international buyers, available desirable properties are always in short supply. This rare combination of scarcity and desirability helps preserve property values, making ownership in Hawaii not just a purchase but a privilege and a long-term investment in paradise.

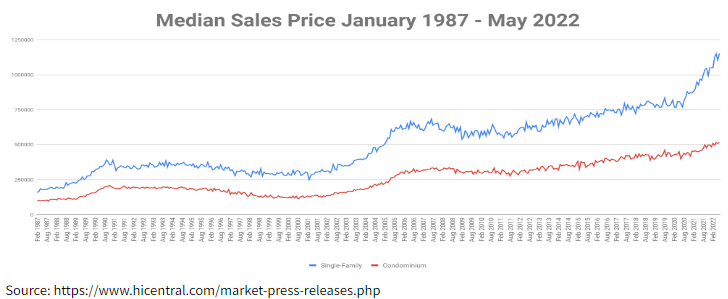

The chart above shows Oahu’s median sales price since 1987. Real estate typically moves in cycles of seven to twelve years, with periods of growth, stabilization, and correction before rising again. During the 2008 financial crisis, while mainland property values dropped by forty to sixty percent, Hawaii experienced only a modest five to ten percent decline, showing the market’s remarkable resilience and enduring appeal.

Fee Simple vs Leasehold

Unlike most places, not all properties in Hawaii are owned outright.

Fee Simple means you own the land and the structure.

Leasehold means you own the building, but pay rent to the landowner for a set number of years. It’s like long-term renting

Single Wall Construction

Many older homes in Hawaii were built with single-wall construction, a style common in the plantation days. The interior and exterior walls are made from one layer of wood, without the insulation or framing you’d see on the mainland. Since temperatures stay mild year-round, builders didn’t need insulation, so walls were made from a single layer of wood—simple, breathable, and cost-effective at the time.

Climate Considerations

When buying a home in Hawaii, climate plays a big role in what to expect day to day and long term. Homes near the ocean offer incredible views and breezes, but the salty air can wear down metal, paint, and windows faster. Windward areas get more rain and humidity, which helps keep things green but can lead to mold or wood rot if not maintained. Leeward areas are drier and sunnier, which means less moisture but usually higher cooling costs.

Cultural and Historical Land

Land in Hawaii carries deep cultural and historical significance, and certain areas come with special rules or restrictions. Some properties are near ancient Hawaiian sites, preservation lands, or heiau (temples), which may limit development or require additional approvals for renovations. Others fall under Hawaiian Home Lands, which are reserved for Native Hawaiian beneficiaries and can only be leased, not purchased, by qualifying individuals.